January 2, 2023- Bear Market Will Bottom Only When We Reach The Opposite of The Speculative Madness Of 2020-21

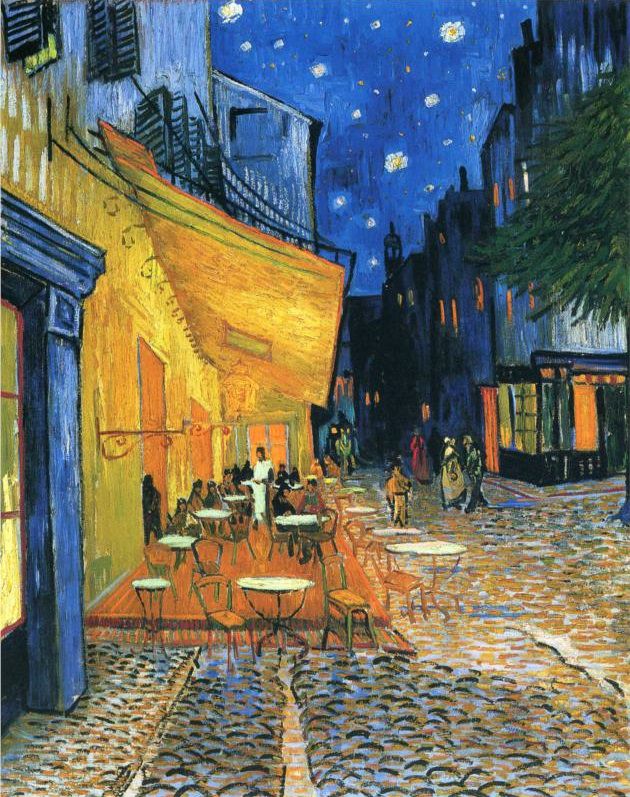

Vincent Willem van Gogh (March 30, 1853 – July 29, 1890) was a Dutch Post-Impressionist artist. His paintings and drawings include some of the world’s best-known, most popular, and most expensive pieces.

Initially, Van Gogh worked only with somber colors until he encountered Impressionism and Neo-Impressionism in Paris. He incorporated their brighter colors and painting style into a uniquely recognizable style he developed at Arles, France.

Over his last ten years, he produced over 2,000 works, including around 900 paintings and 1,100 drawings and sketches.

=============================

“What has been will be again. There is nothing new under the sun.” Ecclesiastes 1:9

“What happens today has happened before and will happen again.” Livermore

“Rather than love, money, or fame, give me the truth.” Henry David Thoreau

“Excesses in one direction will lead to an opposite excess in the other direction.” Robert Farrell

=======================

Answering The $Billion Question

The Opportunity of a Lifetime

92 Years Of McClellan Summation History

Tipping Point for the Ages

=======================

Tracking Account Value: 3,521,647

Intermediate-Term: ~ Downtrend

LOLR Trend: ~ Downtrend

Tracking Account: 28% UVIX, 10% SPXU, 21% TZA, 11% SQQQ, 29% Cash

Stop UVIX 5.48, TZA 29.88, SPXU 15.78, SQQQ 31.77

===================

Friday: 4:00:

Daily LOLR STS

Down Down Up

1/6 6/1 2/5

Breadth: -309/-112

NYMO: -9.15 Rising/NYSI Falling

NAMO: -0.32 Rising/NASI Falling

===================

Opposites define our universe. Nowhere in nature is this more transparent than among human emotions, like joy and sadness, admiration and loathing, interest and boredom, love and hate, ecstasy and grief, greed and fear.

This universal truth is recognized in Bob Farrell’s Investment Rule #2:

Excesses in one direction will lead to an opposite excess in the other direction.

Last week we discussed the fourteen stages of emotions that produce the ever-repeating cycles of the market:

After peaking in the Euphoria stage in 2021, this cycle finds the trading crowd between Denial and Fear as the process heads toward panic, capitulation, and despair in 2023 and 2024.

======================================

Human nature causes the intellectually curious to look back on past irrational behavior and wonder how it could have occurred. For example, in:

1929:

It was not unusual to learn that one’s friends, family members, or neighbors had committed their life savings to trade stocks on margin based on “tips” from their cab driver, barber, or mailman. The “Roaring Twenties” were soon to meet the “Great Depression.”

Unbridled euphoria ultimately led to deep and lasting despair.

Opposites define our universe.

2000:

Or how about the great “dot.com” bubble of 1999-2000? Seemingly levelheaded folks suddenly invested vast portions of their net worth in a stock IPO or a new company that emerged in the previous year or two based on an idea. Most such issues had no hope of generating profits for years or even decades. “Investors” paid multiples of the company’s revenue per share to get a small foothold. As we know now, for every Google that emerged from that bubble, fifty dot.com darlings joined the trash heap of history. The NASDAQ Composite Average lost 79% of its value in the next two years.

A mountain of overblown optimism ended in a valley of exaggerated despair.

The universe has cycled from one extreme to the other since the “big bang” began its journey through open space.

2021:

As irrational, though, as had been these and other manic periods in the last century of stock market history, nothing comes even CLOSE to the descent into madness of the 2020-2021 period. That market energized millions of “self-proclaimed apes” to pour collective billions into names like Gamestop, AMC, and several companies on the steps of bankruptcy courts. Many “apes” used short-term call options to bet chunks of their life savings on such dubious market adventures. The insanity accelerated.

===================================================

Before we review the total insanity of the 2020-2021 period, let’s look at what led up to that particular mania. From mid-2016 into 2018, we witnessed this:

-

Years of Zero Interest Rates and the Fed’s QE policy had engendered a belief in the infallible “Fed put.” As a result:

Riches appeared ripe for the picking as “the Fed put had removed risk from the equation.” Accordingly:

-

VIX registered the lowest fear in recorded history several times throughout 2017

-

The CNN/Money Greed Index at 95 noted its highest greed reading in recorded history on October 5, 2017

-

The NAAIM exposure level of Hedge funds registered its highest commitment in history in 2017 at 110% long:

It was in 2020, however, that the descent into complete insanity emerged:

“Speculation” is far too mild a word to describe the drunken casino atmosphere that had appeared on Wall Street by mid-2020.

Following are several examples among the many that emerged:

-

As the army of apes bought calls, a feedback loop moved stocks higher, causing the apes to buy even more calls, driving stocks prices higher still (note “the first time”):

-

-

Apple Corp’s valuation exceeded the entire Russell 2000! Indeed, by September 4, 2020, Apple’s market cap had exceeded the whole market cap of the Russell 2000. Speculation had driven one issue to a higher capitalization than not 20, not 200, but 2000 companies that we deal with every day. That’s Alexander & Baldwin, Allegiant Travel, Boise Cascade Company, Boyd Gaming Group, Brunswick, Ceasar’s Entmt Corp, Cheesecake Factory, Coca-Cola Bottling, Denny’s Corp, Hecla Mining Co, and a thousand nine hundred ninety more similar companies.- COMBINED.

-

The following record refers to the total dollars spent buying calls, the percentage of NYSE volume represented by these calls, AND the share of dollar value moving into call options daily compared to NYSE stocks. Each set records never before having occurred since humankind walked this planet.

5. XX- Think about this: As billions poured into options daily, more than 75% of those $Billions went into options of less than 14 days of maturity! This level of pure, raw speculation makes the frantic activity of the 1920s look like a peaceful Springtime walk through the park.

You must be logged in to post a comment.